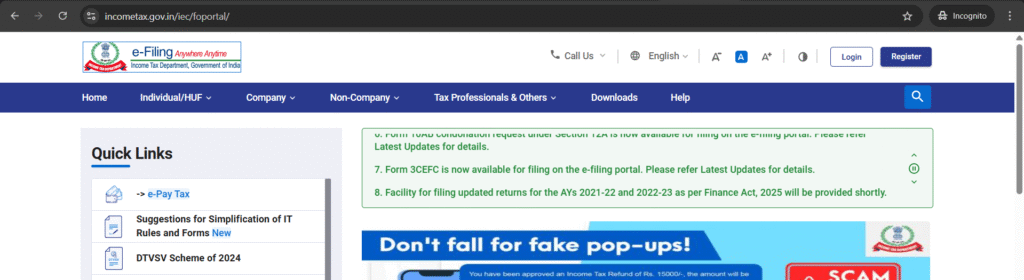

Income Tax Return (ITR) Last Date for FY 2024-25 (AY 2025-26) is 31st July 2025

What is ITR Filing and Why It’s So Important?

ITR (Income Tax Return) filing is the process where you declare your annual income, claim deductions, and calculate your tax liability.

Why file ITR?

- Claim TDS refunds

- Use ITR as proof for loans, visas, or credit cards

- Avoid penalties and notices

- Build a credible financial profile

How to File ITR Easily (Step-by-Step)

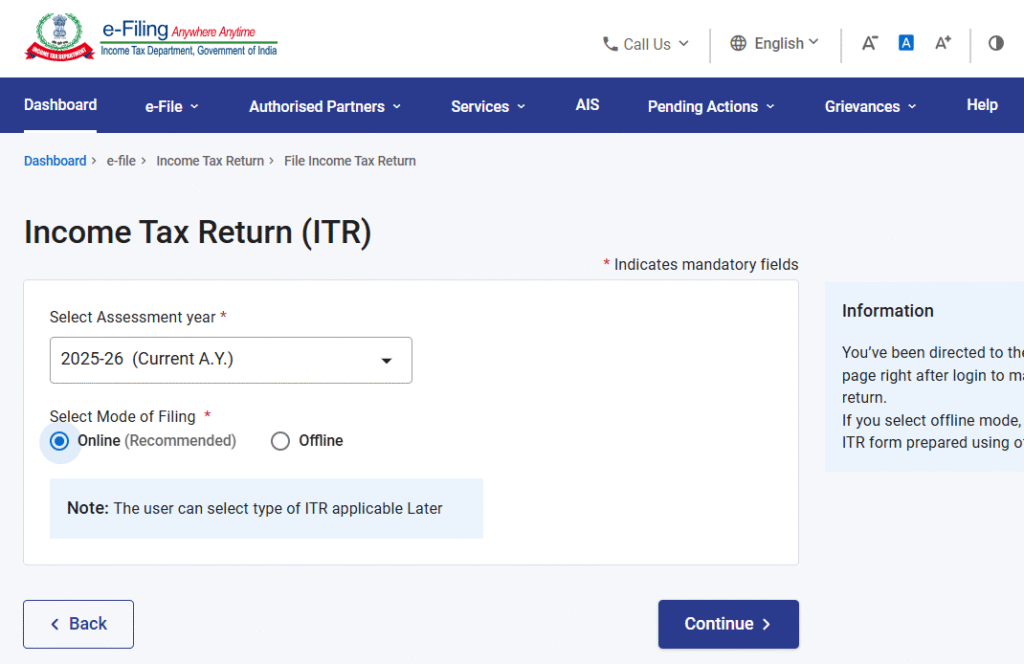

Step 2

Go to File Income Tax Return

Step 3

Choose the relevant Assessment Year: 2025-26

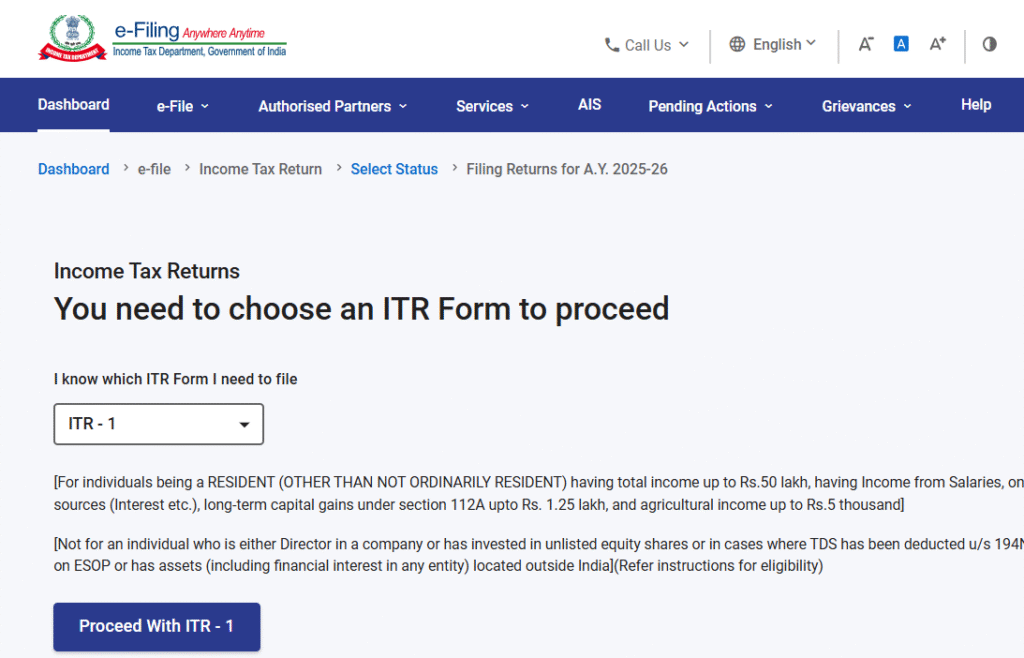

Step 4

Select the correct ITR Form

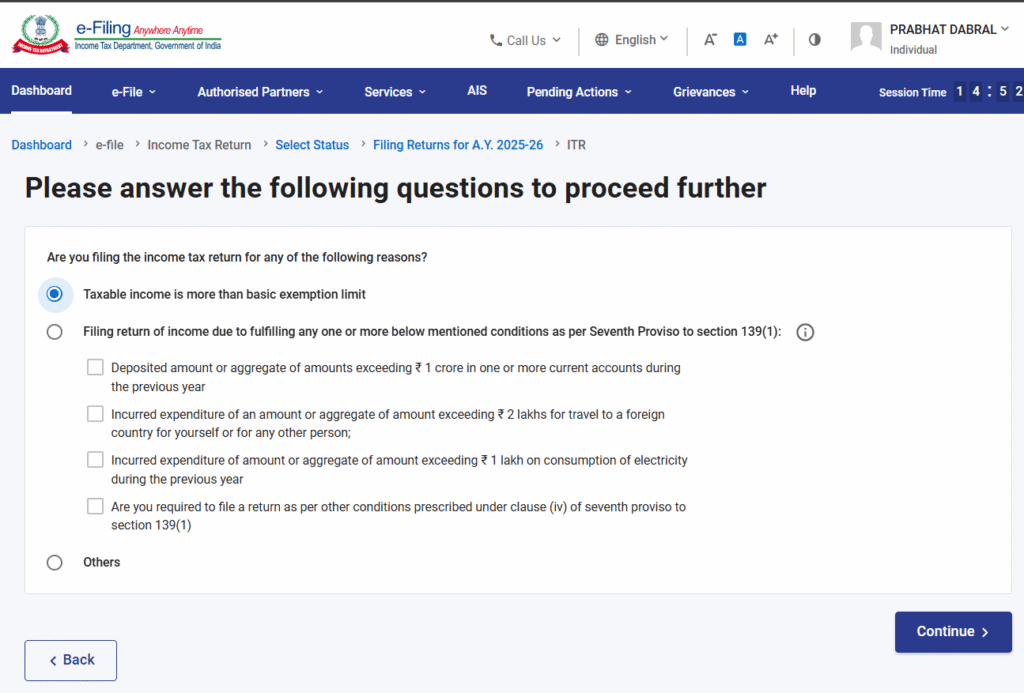

Step 5

Choose the relevant option and click Continue

Step 6

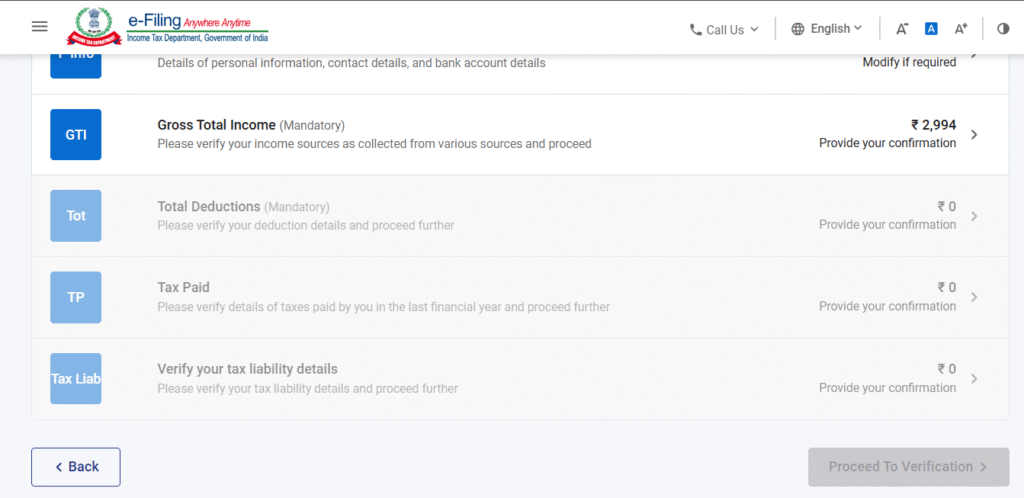

Verify All the prefilled details including income details filled by your Employer and from other sources. Fill all the deductions (80C, 80D, 80GG etc.) and Click on Proceed to verification

Step 7 : Validate, verify, and submit your ITR

Step 8 : E-verify via Aadhaar OTP, bank account, or net banking

👉 Detailed process to file the Income Tax Return for FY 2024-25.